General Liability vs. Professional Liability Insurance Coverage

What is the difference in general vs professional liability insurance? Learn the nuances of each, how they are similar, and how they are different.

Business owners and operators commonly confuse general vs. professional liability insurance, asking why they need coverage for either, and in some cases, both.

If you’re curious about the difference between general liability versus professional liability insurance, continue reading to learn about the nuances of each, how they’re similar, and how they differ.

What Is General Liability Insurance?

General liability insurance is a type of policy that protects your business in claims of bodily injury incurred on your commercial premises or when using your product; damage to the plaintiff’s property; or damages caused by slander, libel, copyright infringement, and more.

General liability insurance provides coverage for physical damages.

Most businesses need general liability insurance coverage given the wide range of exposures a policy will cover. In fact, it’s estimated that 40 percent of businesses will face a lawsuit that a commercial general liability insurance policy would cover.

If your business gets slapped with a lawsuit, the court costs and legal fees alone can be financially devastating, even if you’re not at fault. This is why it’s typically recommended that all businesses have general liability coverage.

If your business sells a physical product, the general liability policy will cover injuries and damages caused by defective products up to a certain point. You may also consider a product liability policy in addition to your general liability coverage. Product liability insurances can go even further to protect your business from faulty software, defective buildings, or environmental exposures.

The general liability policy is a blanket policy that covers a wide range of liabilities, but there are limitations on what general liability will and will not cover. For example, general liability policies tend to explicitly exclude negligence claims and injuries caused by your employees’ actions. This is why many businesses opt for Employment Practices Liability Insurance (EPLI) in addition to general liability and product liability coverage.

Employment Practices Liability Insurance can be broken into three categories: Coverage B, which covers wrongful termination and general harassment, Coverage C, which covers general discrimination practices and Coverage D which covers general compliance issues.

What Is Professional Liability Insurance?

There are a few considerations to understand when looking at general vs professional liability insurance. A professional liability insurance policy, also known as errors and omissions insurance (E&O), is a type of insurance policy that protects your business in claims of negligence, malpractice, errors, and omissions during the fulfillment of a professional service.

Professional liability insurance provides coverage for financial damages.

When considering general vs professional liability, there are many factors to consider. If you’re educated and trained to provide a service or trade — such as a financial advisor, accountant, doctor, lawyer, or dentist — you should have professional indemnity. When clients incur financial losses because of inadequate or incomplete service on behalf of your business, you are exposed to a lawsuit.

Even if you perform your duties and responsibilities, if the customer’s expectations aren’t met or they’re otherwise dissatisfied with your service, you could be sued.

Professional liability insurance can cover you in the event you provide clients with bad advice or misrepresent the results and outcomes.

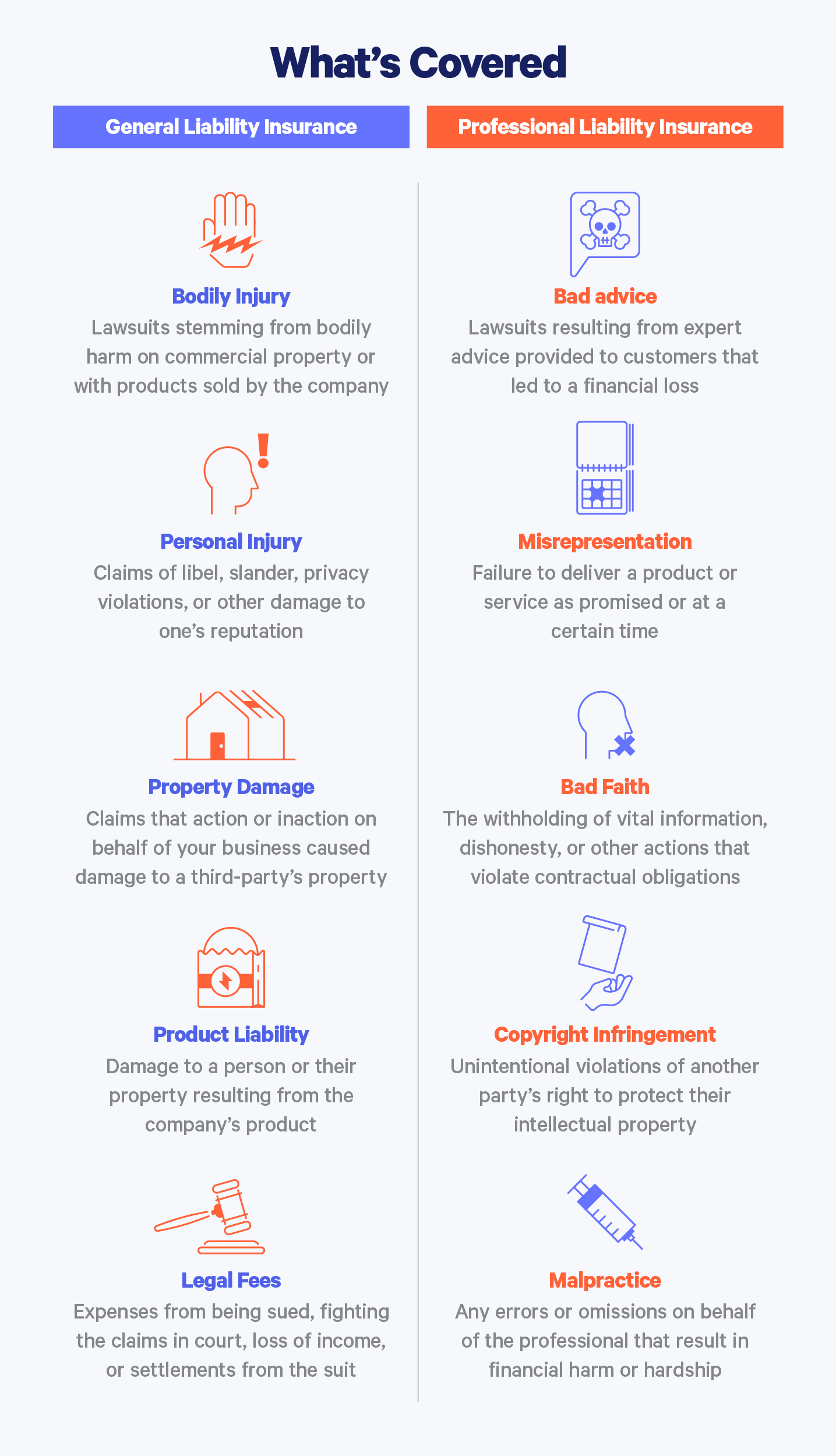

Here are the different types of coverage between general liability insurance and professional liability insurance:

Differences Between Professional vs General Liability

There are some differences between general vs professional liability insurance that might help clarify what policy or policies you should consider for your business.

-

Professional and General Liability Cover Different Exposures

General liability can cover your business for a wide range of claims including bodily injury, personal injury (as a result of libel, slander, etc.), property damage, legal expenses, product liability, and even manufacturing-related injuries.

Whether it be a customer, visitor, vendor, or other third-party, if a physical injury occurs on or with your business’ property, you could face a lawsuit that general liability insurance would protect.

Professional liability insurance, on the other hand, offers protection for professionals who provide bad advice, act in bad faith, infringe on copyrights, or misrepresent themselves or their services. If someone experiences a financial loss because of a service-provider’s errors and omissions, they can sue said service provider — which is why you should consider professional liability insurance if you provide services to customers or clients. Still, there’s more to understand for general vs professional liability. Read on.

-

Claims-Made Coverage Contingencies

General liability insurance is a “claims-made” policy, which means if you have the insurance when the claim is filed, you will be covered, regardless of when the alleged event occurred.

Professional liability insurance is also a claims-made policy but has a retroactive date exception. This means if the event that led to the claim occurred before the retroactive date of your policy, the current insurance policy won’t cover the claim. This is why it’s important for service providers to remain vigilant when their policy coverage could lapse and should be renewed. If gaps in coverage do exist, businesses should look into prior acts coverage as well.

Similarities in General vs Professional Liability

Although there are significant differences in what they cover and how they cover them, there are ways in which general and professional liability insurance are similar. Because of these areas of isolation and overlap, many businesses benefit from both types of policy simultaneously.

-

Required By Partners, Vendors, or Law

When entering into a contract with a strategic partner, vendor, or otherwise, there may be a stipulation that your business must be insured, either with a general liability policy, professional liability policy, or both.

Some states legally require professional liability coverage depending on the industry or service your business operates. For example, many states require that medical practitioners have malpractice insurance, a form of coverage under a professional liability policy.

-

Cost Structure Varies

When evaluating the cost of both general and professional liability insurance, your premium will depend on specific factors of your business.

For example, if you’re looking to purchase a general liability insurance policy as a remote contractor, you’ll have very different levels of risk compared to a grocery store owner.

In the same vein, a contractor taking out a professional liability policy will experience very different costs if their clients are multinational billion-dollar businesses compared to local brick-and-mortar stores.

How to Decide Between General vs Professional Liability

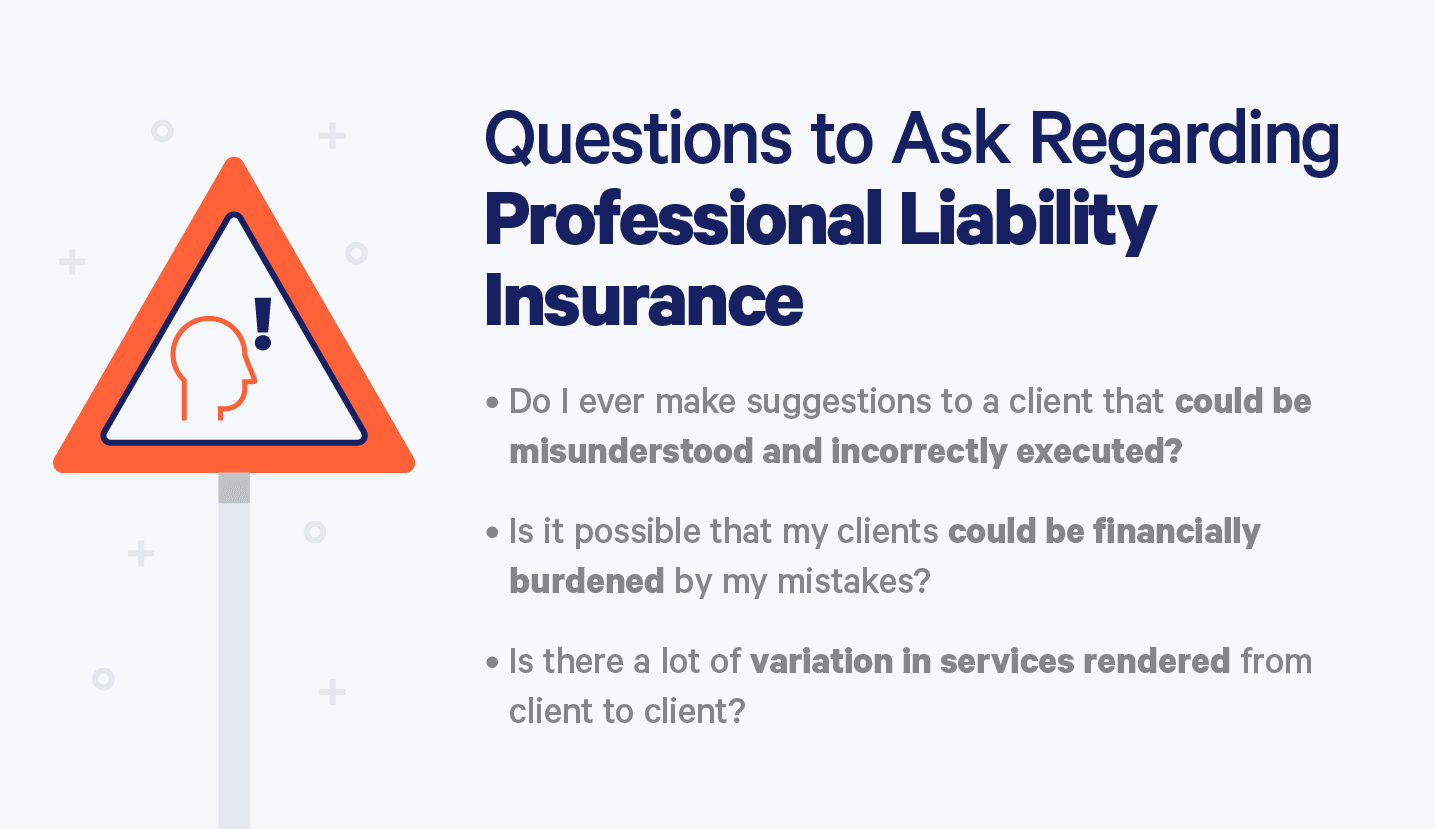

If you’re still considering whether you need general liability versus professional liability insurance, ask yourself a few questions.

You might think that if your customers only interact with your business online, you don’t need a general liability policy. In most cases, however, you could still be exposed to personal injury lawsuits depending on your site’s content, such as copyright infringement or libel lawsuits.

Most industry experts would recommend having a general liability insurance policy. Even if you believe your business has an extremely low risk of being landed with a lawsuit, discuss with an insurance broker to learn more or get your general liability insurance quote.

If you answered yes to any of the above, you should consider exploring your options with an insurance broker and getting an instant professional liability insurance quote. Embroker can tailor a professional liability policy to uniquely meet the needs of your business. Additionally, Embroker offers the first-ever, completely digital legal professional liability product, custom-created to protect law firms from common professional risks and potential legal malpractice claims.