Crafting a Business Emergency Plan for Your Startup

Startups can fall prey to a wide array of emergencies. To make the best of these scenarios be prepared with a business emergency plan.

Table of Contents

Protect your business today!

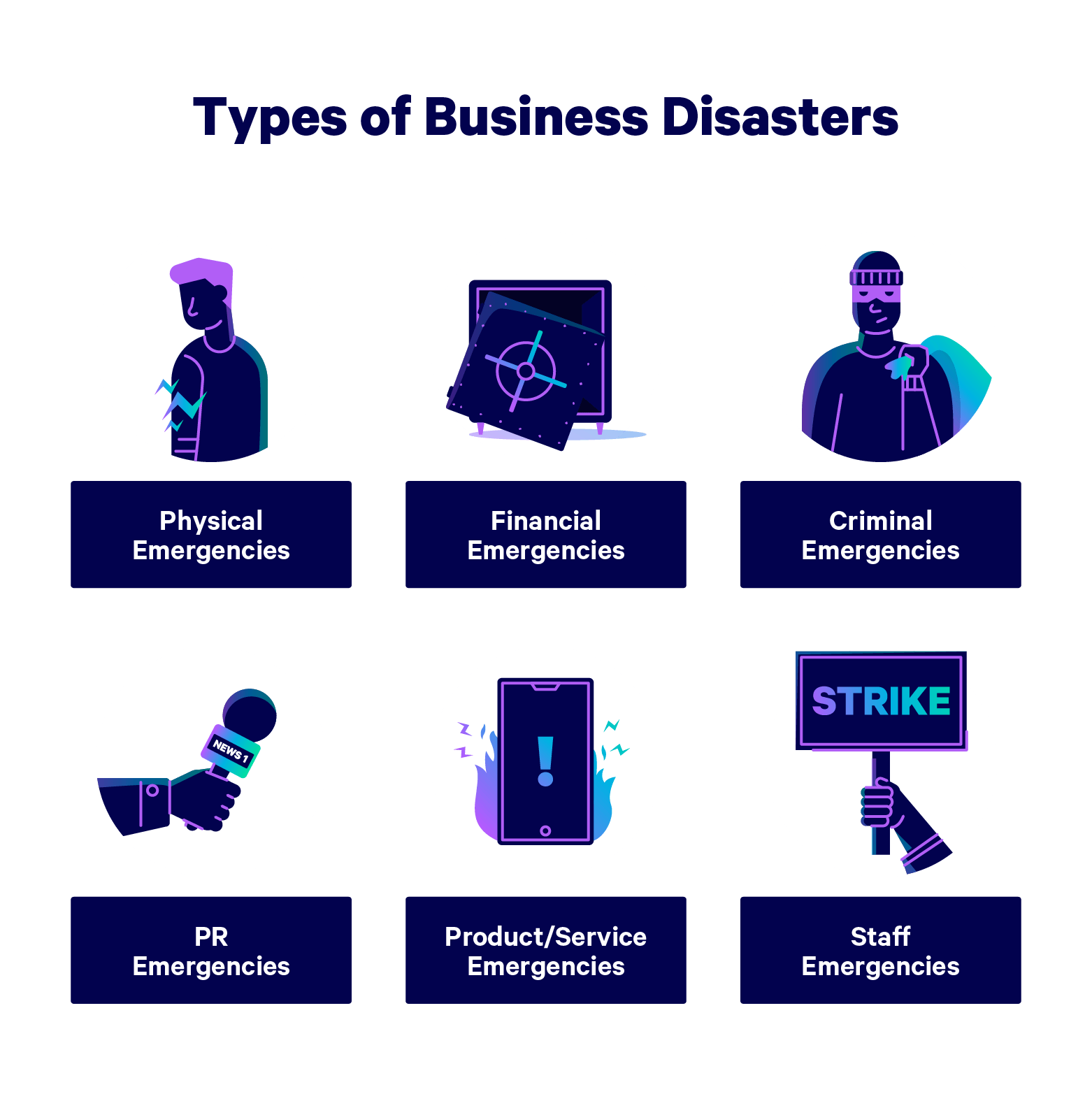

Get a QuoteJust like individuals and families need to be prepared with plans and resources to make it through unexpected disasters, businesses also need to be ready for any sort of emergency that might crop up. Unlike individuals, though, companies can fall prey to a wider array of emergencies like PR fiascos, product malfunctions, platform outages, and more.

Startups especially require far more preparation and resources than individuals or even regular companies to make recovery possible. Keeping an ecosystem of people, products, and systems afloat in a storm is a daunting challenge, so it’s absolutely essential to make sure you have all of the necessary plans, tools, and resources on board.

Table of Contents

- Business Emergency Planning vs. Business Continuity Management

- Conducting a Business Risk Assessment

- Developing a Mitigation Strategy

- Emergency Plan Development

Business Emergency Planning vs. Business Continuity Management

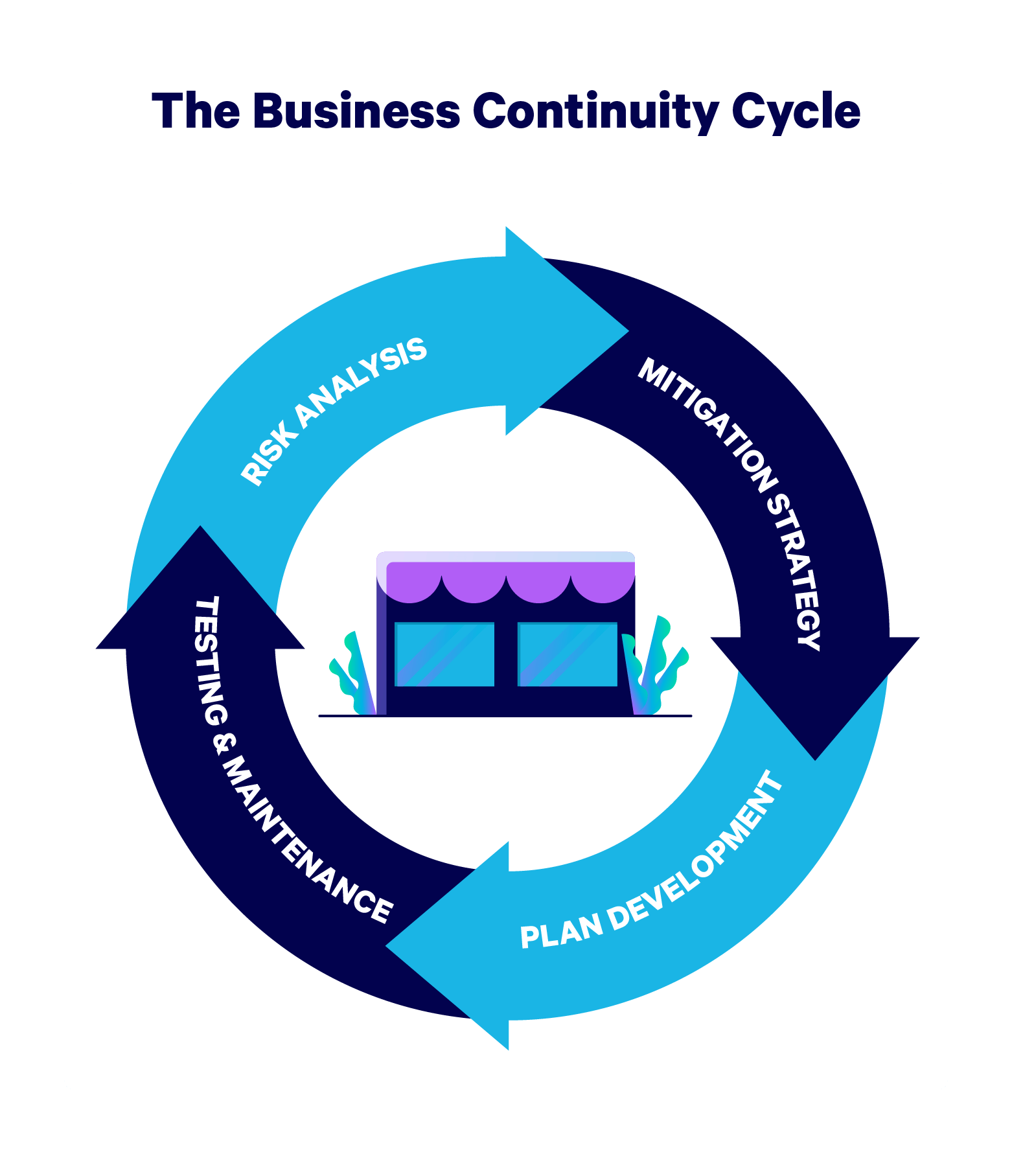

Business emergency planning is part of a larger process called business continuity management, which includes emergency response and recovery, continuous risk analysis, strategy adjustments, and periodic testing and maintenance of existing emergency plans. While an emergency plan will ensure your startup survives an emergency in the moment, a business continuity plan will help your company weather both the short- and long-term effects of a disaster.

The business continuity cycle consists of four stages:

- Risk Assessment

- Mitigation Strategy

- Plan Development

- Testing & Maintenance

Starting with a risk assessment allows you to ensure you’re preparing for the right things and prioritizing your efforts appropriately. Then, you’ll need to develop a mitigation strategy that outlines all of the potential damage of a given emergency and what’s required to lessen or eliminate your company’s losses.

Your mitigation strategy should lay out what sorts of emergency plans will be required for a particular disaster — for example, you can mitigate damage from a cybersecurity breach by training your staff on early detection protocols and ensuring you have a rapid response plan in place. Different types of emergencies require different plans; in some cases, it’s smart to have multiple plans in place in case of unexpected obstacles. Once your plan is complete, you’ll want to test it regularly and make any necessary updates.

The process then repeats with new analyses that account for any changes or learnings acquired during the testing and maintenance phase. You should also be sure to update your continuity plan whenever a new factor comes into play, like opening a new office location or acquiring new supplies, equipment, or tools.

Conducting a Business Risk Assessment

To prepare adequately for emergencies, you need to identify what could possibly occur. The most efficient way of doing this is by conducting a risk assessment, which is essentially a list of potential emergencies and the relative likelihood and potential severity of each event.

You can create a risk assessment document on your own, but we’ve also created a template that can help save you some time.

To fill out your risk assessment document, start by listing all of the disasters that could potentially impact your business. Be sure to include not just physical disasters but also financial emergencies, product or service failures, staffing emergencies, and public relations faux pas.

Beside each example, rate the probability of the disaster on a scale of one to five, with one being the least likely. Then, assess the impact the disaster would have on your business, again on a scale of one to five, with one being the least severe. Multiply these numbers to calculate the event’s importance.

Events that are either very unlikely to occur or will have very little negative impact on your company will have low or negligible importance scores. Events that are reasonably likely and would have a medium-to-high impact on your company will receive high or very high importance scores.

When your risk assessment is complete, disregard any event with a negligible importance score and then arrange the remaining events from highest to lowest importance. You should consider these emergencies as you move forward with your preparedness plan.

Developing a Mitigation Strategy

Before developing an emergency plan, you need to determine your goals for a particular emergency. There are four primary goals you can set when crafting your mitigation strategy:

Avoidance

The ideal situation is always that you’re able to avoid sustaining any damage from an emergency whatsoever. It’s not always possible, but well-prepared companies that act quickly can sometimes avoid being negatively impacted by a potential disaster.

Examples of disasters whose impacts on a startup can be avoided include:

- A small kitchen fire that’s extinguished before it spreads.

- The unexpected death of a key employee whose team is flexible and prepared to adapt operations accordingly.

- A natural disaster that significantly damages offices but does not interrupt operations because employees had a remote or alternate office plan in place.

The key to avoidance is advanced planning. For higher-priority emergencies that are likely to have a greater impact, it’s often worth investing in training and resources since the cost of preparation is rarely greater than the cost of recovery.

Acceptance

In some situations, the smart move is to accept the effects of a particular event. If the costs associated with trying to mitigate or avoid an emergency are greater than the cost of simply enduring the event’s impact, it makes more sense to simply batten down the hatches and plan to ride out the storm.

Scenarios best suited to an acceptance strategy are typically smaller, like a minor run of bad press or a financial hit that hurts but won’t sink the company or force you to make layoffs. Alternatively, events that are so massive that there’s nothing you could do to affect their outcome—like a meteor—would also fall into this category.

Reduction/Control

Most emergencies will fall into this category. When events can’t be avoided completely, but there’s plenty you can do to lessen the damage and recover more quickly, your best strategy is harm reduction.

Examples of damage reduction strategies include:

- Investing in insurance to avoid paying for potential repairs or lawsuits out of pocket.

- Hiring an in-house lawyer to handle potential legal issues as soon as they arise.

- Crafting a communication strategy for assuaging potential client and investor concerns

- Building a plan for getting back up and functioning under adverse circumstances so no business is lost while you cope with disaster recovery.

More than any other strategy, damage reduction relies most heavily on the advanced preparation of the necessary emergency plans and tools. When employees employ security best practices, all of your data is backed up and secure, and you’re ready to deploy the necessary tools and resources without losing time in your response, the damage your company sustains will be significantly less.

Transference and Risk Sharing

Finally, it’s possible to shift at least a portion of the burden of risk or damage onto another party to avoid sustaining company losses. The two means of doing this are “transference” and “risk sharing;” both strategies must be put in place and agreed to by all parties before the risk or damage is incurred.

Risk Sharing

Let’s say you hire a company to store and secure your startup’s data. Should that company experience a data breach, it’s not just your data that may be compromised—your clients may also suffer damages, for which they will hold your company responsible.

In this scenario, you can reasonably expect the security firm to bear at least a portion of the consequences of your clients’ compromised data. When your clients entrust their data to you, you assume the risk of a potential breach, but if you hire a third party to handle your data security for you, that risk is shared by your company and that firm.

Be sure to discuss how potential disasters will be handled at the beginning of your relationship with a third party, and include specifics in the terms and conditions of your contract agreement before it’s signed. The contract should clearly state what percentage of each type of potential damages each party is responsible for, to avoid confusion and conflict in the aftermath of the event.

Transference

Suppose your contract with the data firm states that your company will be responsible for 50% of the financial damages incurred by your clients in the event of a breach. This risk-sharing clause has decreased your responsibility significantly, but the average cost of a data breach in the U.S is over $8 million—and you’re still on the hook for half of that.

You can further reduce your risk by transferring it onto another entity, usually by investing in insurance that covers the particular types of risk to which your startup is most exposed.

Cyber insurance covers first-party costs associated with data breaches as well as financial injury claims from clients whose information was involved in the leak. Errors and omissions insurance will protect you against client lawsuits in cases where your company is directly at fault. Depending on your company’s size and type of services you provide, there are a number of other policies you should be sure to have to transfer the risk of potential disasters onto your insurance provider.

Emergency Plan Development

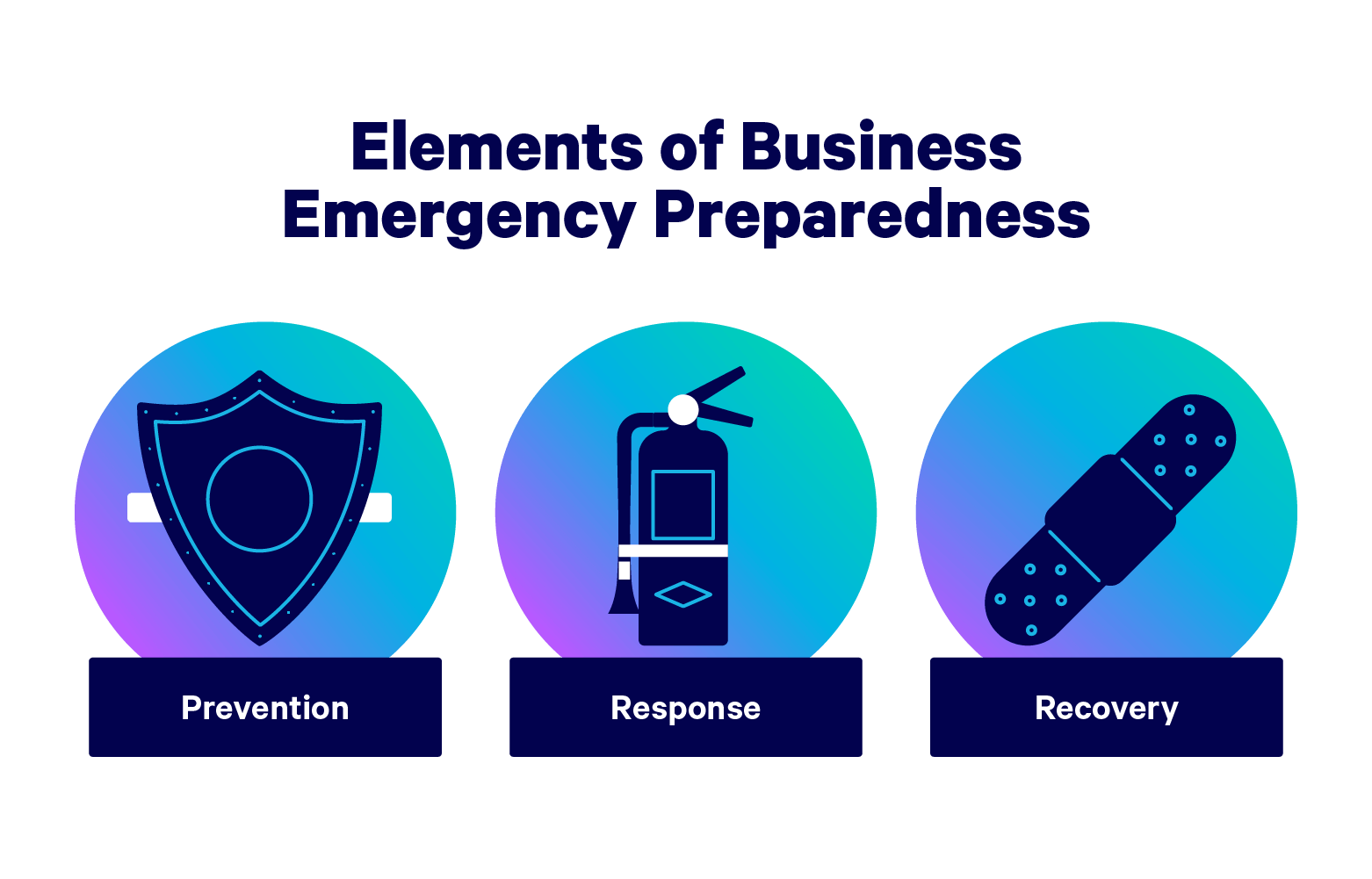

There are three basic stages of disaster preparedness for your business: preparation, response, and recovery. Whether your startup can bounce back from a given disaster depends on how well you and your team prepare a plan for all three stages.

Preparation

In the throes of an emergency, very little will be within your control. The time to affect the outcome of an emergency is long before the event happens, during the preparation stage. The more thorough your plans and the more well-stocked your emergency resources, the more damage you’ll be able to mitigate when it comes time to respond to the disaster in question.

Preparation tasks include:

- Setting an emergency chain of command.

- Compiling emergency contacts for employees, local authorities, clients, suppliers, insurers, and other key stakeholders.

- Training staff on how to respond in different emergency scenarios.

- Preparing and protecting essential documents.

- Establishing a day-of communication plan.

- Enrolling in necessary insurance to protect your people, your property, and your business.

Different emergencies may require different preparation tasks. For example, the emergency contacts you’ll need in case of fire won’t be helpful in the event of a cybersecurity breach, and vice versa. Take the time to walk through each emergency step-by-step and ensure you and your team are prepared with the tools and resources you’ll need if and when disaster strikes.

Response

Many emergencies can be halted or minimized if you and your team respond to threats quickly and confidently. A small fire in the office kitchen can be a minor incident or a major emergency, depending on whether or not your employees have been trained to avoid using water on a grease-fueled flame.

Quick, effective responses are possible when teams have been trained ahead of time to know:

- What emergencies can be handled and what emergencies require immediate evacuation.

- How to handle small emergencies like basic first aid, small fires, and mild- to medium-intensity weather events.

- The emergency “chain-of-command” — who they will report to in the event of an emergency.

- What authorities should be called for different emergency situations.

- How to efficiently account for the location and safety of all persons present in the office and contact any who may be missing.

- What to document during and after the emergency to fill out the necessary insurance claims.

Your team will also need to know how to handle key elements of their job during an ongoing emergency event. Employees should be ready to:

- Recognize warning signs of a cyber or security breach and alert the appropriate people immediately.

- Communicate essential information to clients without panicking, disclosing secure information, or otherwise giving cause for concern.

- Understand what information suppliers and other stakeholders will need and communicate that information effectively.

- Keep teams and direct reports calm, organized, and operational.

As a business, your clients and investors will also gauge their confidence in your ability to recover based on how confidently you handle an emergency as it’s happening. No company should prioritize communication with stakeholders over the health and safety of their staff, but companies that are well-prepared for disasters will have a plan for emergency operations that allows staff to concentrate the majority of their resources to emergency response without leaving clients, suppliers, and investors in the dark.

Recovery

How you bounce back from a disaster will affect your bottom line for months or even years to come. Depending on the type and severity of the event, you may come out of the disaster with a smaller staff, fewer resources, and new obstacles you’ll need to circumvent to get back to business.

Some things to think about when it comes to planning your recovery strategy include:

- Skeleton structures: What is the absolute minimum your company needs to remain up and running? What employees, locations, and tools are essential to your ability to do business?

- Short-term alternatives: What stop-gap solutions can help you remain operational as you recover? For example, if your office building will be uninhabitable while it undergoes repairs, do you have a temporary workspace or a remote work transition plan in place?

- Recovery labor: Long-term recovery often involves additional tasks like ordering repairs and filing insurance paperwork. What staffers have bandwidth to take on this recovery work? Will you need to reorganize staffers’ workloads to make room for these tasks?

- Cybersecurity: If your company has been displaced, have you verified that your data is secure in your temporary location? Are remote workers taking necessary precautions to keep their devices secure?

- Data storage: Whatever system you use for automatic backup storage will be what saves you from further disaster if an emergency occurs. Will your backup protocols adapt to potential relocation or remote work during your recovery period? How will you ensure backups are maintained while your team is in flux?

No matter how well you prepare for a quick recovery, it’s likely that you’ll experience a period of time after a disaster during which you’re unable to do business. Depending on how long that period lasts, you may lose clients or sustain financial losses as a result. In addition to policies that cover specific risks and disasters, you should also consider investing in business interruption insurance to cover any damages you endure in the aftermath of an emergency while you’re unable to do business.

As the COVID-19 pandemic has proven, large-scale disasters can come from anywhere, and at any time. Companies that invest in training, insurance, and robust contingency plans put themselves in a much greater position to recover—and in some cases, being well-prepared can make it possible to take advantage of uncertainty to benefit your team’s growth.

The more strenuously you assess and prepare for the risks facing your business, the healthier your startup will become, and you’ll clear the way for exponential growth no matter what obstacles lie ahead.