What is the “Investor Factor”?

Venture capital investors and startup founders are united by a shared mission to manage risks for startups to help them grow and achieve success.

Protect your business today!

Get a QuoteStartups at every stage of their growth cycle are defined by two important factors: their capacity for handling risk and their ability to attract funding. Risk-taking is an essential part of the growth and innovation that startups need to succeed. Without adequate investment, however, no amount of risk-taking is enough to take a startup to the next level.

Startup investments, especially in the form of VC funding, are often seen as mitigating risk. After all, many founders and entrepreneurs seek to build relationships with VCs because doing so gives them access to the capital they need to grow their business. For many startups, the ideal investor will act as a strategic partner with the kind of experience, expertise, and connections that can prove invaluable to new and smaller companies.

What about the risks that come with receiving investments and maintaining investor relations? The truth is that all startup founders will face significant challenges trying to secure and maintain funding while keeping their investors happy. Disagreements over the strategic goals of the company, growth targets, and other issues are inevitable, and they always come down to what kind of risk-taking is acceptable to founders and investors.

How much sway do investment firms and VCs have over the decision-making and goal setting at the startups in which they invest? The answer to that question depends on the investor factor.

Based on the results of the 2022 Embroker Startup Risk Index Report, the investor factor is a concept designed to highlight the relationship between startup founders and investors when it comes to the risks faced by startup companies. For startups at every growth stage, understanding the different approaches to risk-taking between founders and investors is vital to ensuring the long-term success of their relationships with their investors.

This article will discuss the investor factor by highlighting important insights from Embroker’s Startup Risk Index Report. We will then consider the significant economic and market conditions that are currently driving VC funding, and offer strategies for startups to manage the risks they face while maintaining strong investor relations.

How founders and investors approach risk

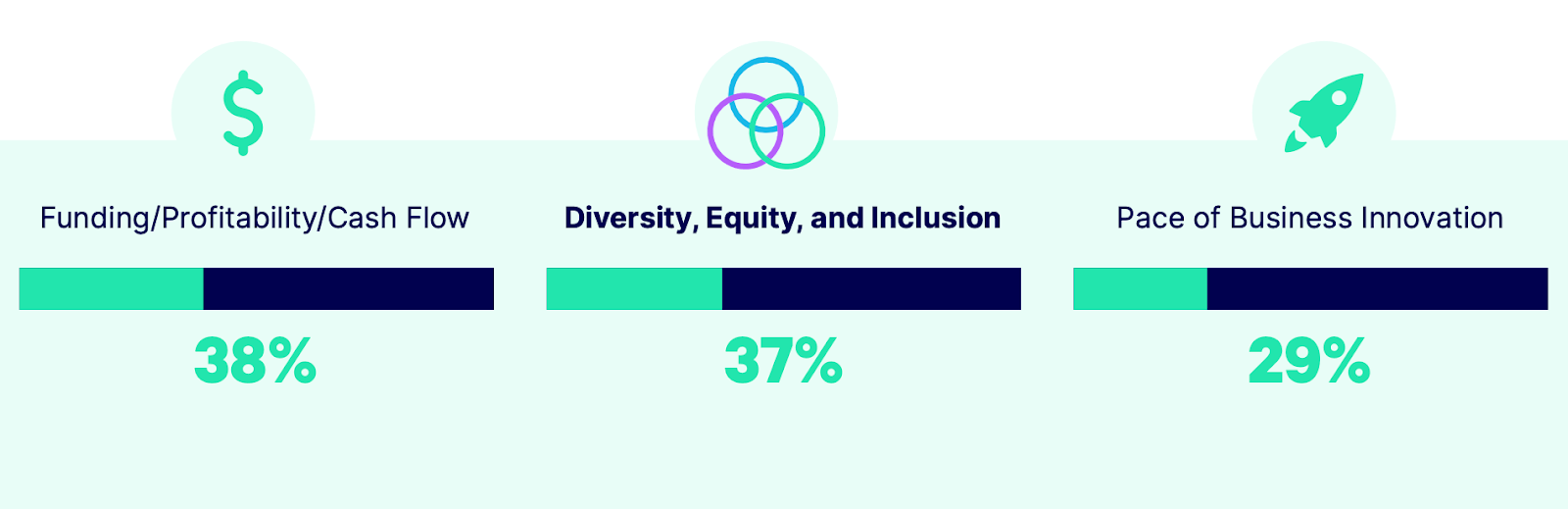

The results from Embroker’s Risk Index Report survey provide us with important insights into the mindset of both founders and investors when it comes to risk. The survey’s findings clearly indicate that, across the board, founders consider their investors’ main concerns to be fundamentally financial. 38% of founders ranked funding, profitability, and cash flow as primary concerns for their investors.

Concerns over diversity, equity, and inclusion followed closely, with 37% of founders highlighting DEI initiatives as priorities for their investors. 29% of founders also mentioned the pace of business innovation as a top investor concern. Significantly, the survey findings indicate that founders consider financial factors and DEI concerns to be of higher priority to their investors than issues such as cybersecurity or reputation.

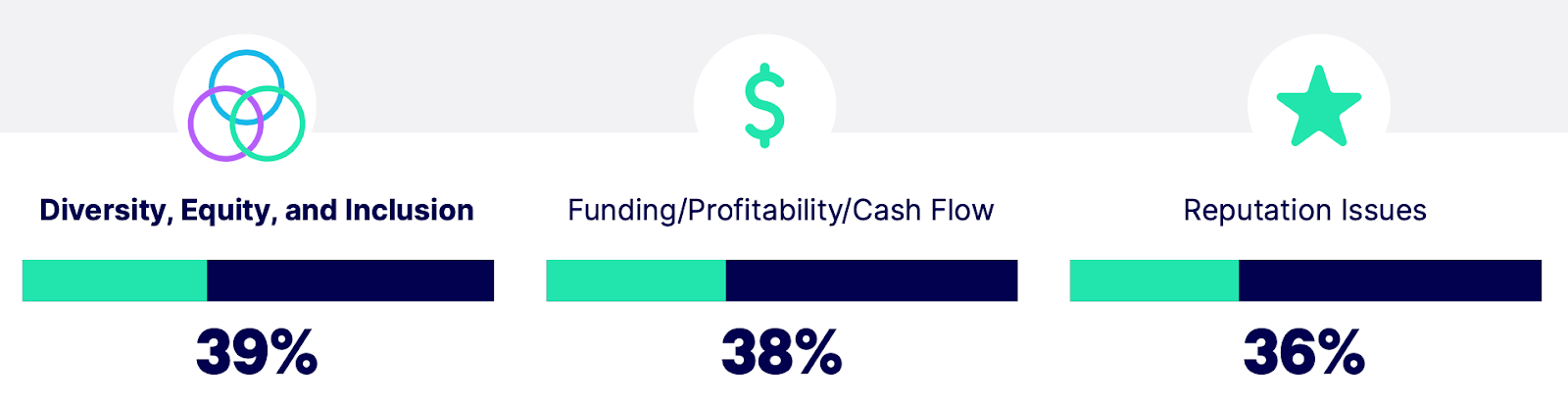

Further evidence from the survey also makes it clear that, as startups grow, investor expectations and demands change. Series A founders ranked DEI as the top concern for their investors, followed by financial and reputational concerns:

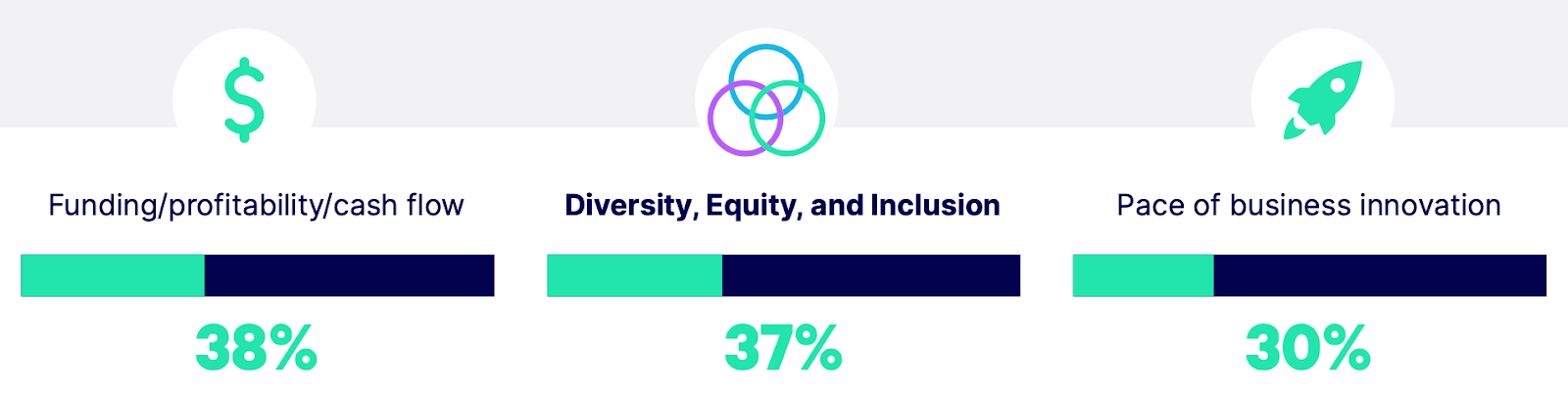

Financial and DEI issues were also the top investor concerns according to late stage founders:

These results strongly suggest that founders feel pressure from their investors to take on more social and financial responsibilities as their companies grow and mature. The striking focus on DEI is an indication of just how important diversity, equity, and inclusion initiatives are to investors and businesses. Understanding DEI is vital for any startup that wants to succeed in the current business environment, not least because such initiatives are valued as much by employees and business leaders as they are by investors. Interest in social issues is a constantly evolving aspect of how startups and small businesses manage risk, as evident in the responses to the recent Supreme Court decision to overturn Roe v. Wade in big tech and Silicon Valley.

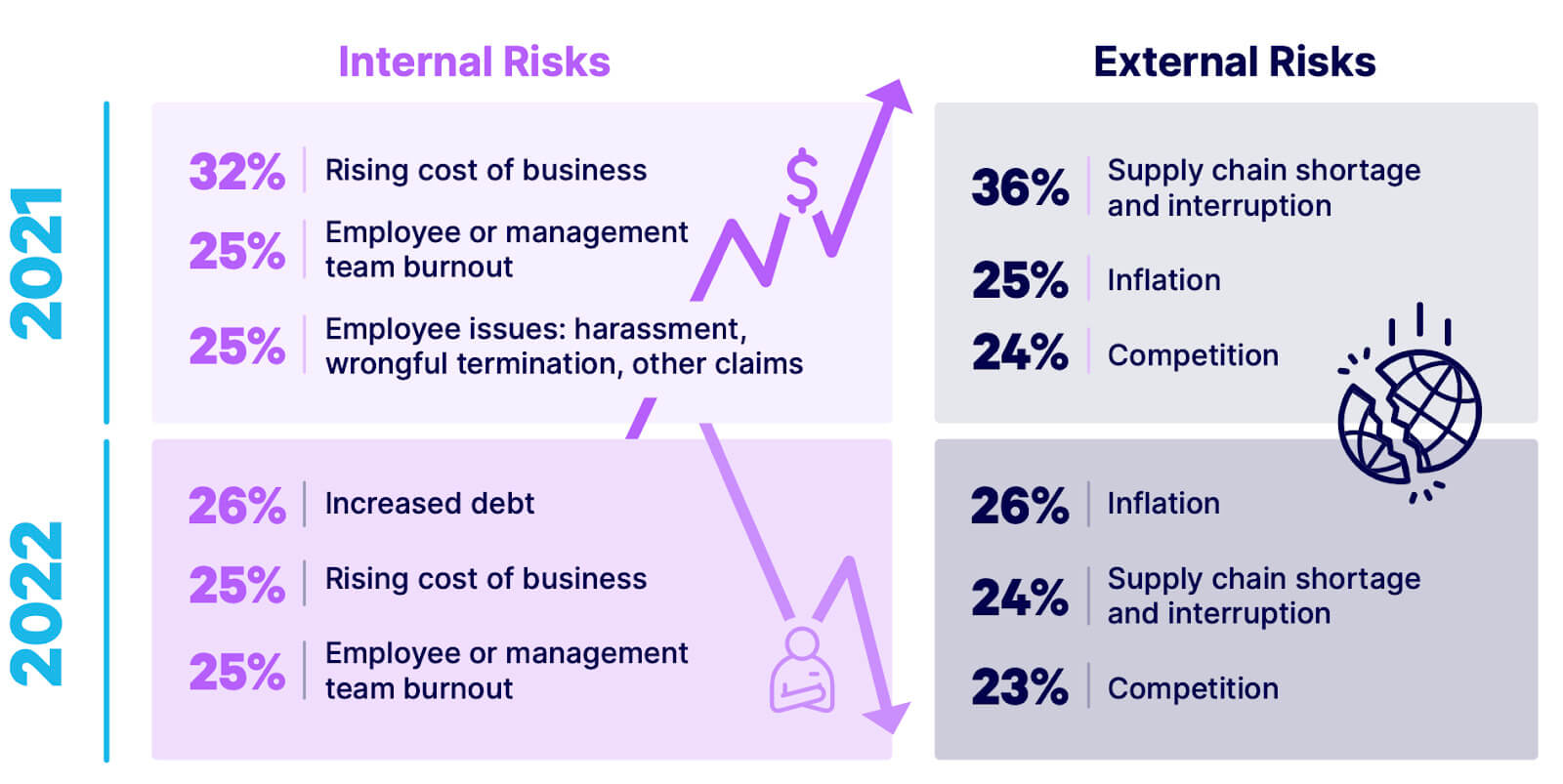

The Risk Index Report also highlights the significant difference in the risk priorities between founders and investors. Founders were surveyed about both internal and external risks. The results indicate that 26% of founders considered increased debt to be the biggest internal risk factor, followed by the rising cost of business and employee or management team burnout (both at 25%). 26% of founders listed inflation as a major external risk for 2022, followed by supply chain shortages (24%) and competition (23%).

The differences between what founders consider to be risks to their businesses and what they regard as their investors’ top concerns are stark. These results suggest that there is a need for founders to reassess their relationships with their investors in terms of managing risks and expectations for their companies. How can founders tackle the investor factor and manage investor expectations and demands?

The survey results clearly indicate that both investors and founders are concerned about the risks posed by external factors. The priority that investors give to DEI initiatives, for example, shows an understanding of the significant social movements of the last few years and the increased sensitivity to creating inclusive, nurturing work environments. At the same time, founders’ worries over inflation and other financial factors highlight the difficult economic environment currently faced by all businesses.

These concerns are not incompatible or mutually exclusive. In fact, both investors and founders share an understanding of the complex economic and social conditions that startups are faced with at the moment. The only difference is in terms of what specific aspects investors and founders choose to highlight. To bridge the apparent gap between their different approaches to risk, we need to take a look at the larger economic context that influences investment and VC funding decisions.

The state of venture capital investors funding in 2022

When it comes to the current state of VC funding, headlines such as “Why VC funding is drying up” from the Financial Times seem to provide a pretty clear summary. It’s easy to see why: there is no doubt that the startup community has been hard-hit by all the economic uncertainty so far this year. VC giants such as Sequoia Capital and Y Combinator have issued warnings to investors and startups to prepare for significant downturns in the market. Faced with recession fears and market volatility, many startups have had to resort to retrenchment.

It’s not all doom and gloom, however. While venture capital investors funding slowed down during the first half of 2022, VC firms have continued to raise new funds both in the US and abroad. According to Pitchbook and the National Venture Capital Association (NVCA), while Q2 of this year saw a tighter investment in the VC market, fundraising remained strong, particularly in the earliest venture stages and for large VC funds. IPOs, however, reached a 13-year low. Moreover, the deal value declined across all stages due to the deterioration of the broader economy and the equities market.

The decline in the first half of 2022 has to be understood in comparison to the remarkable performance of VC firms in 2021. Last year set a record for VC investments in the US, with the total value of those investments reaching $330 billion, almost double the previous year. So while the value of VC deals declined in the first half of 2022, it stood at a still-impressive $144.2 billion.

The VC market thus remains resilient, but has clearly felt the effects of the broader economic uncertainty. That uncertainty has only increased recently with growing fears over a possible recession and even higher interest rates.

For founders and investors, the broader economic slowdown complicates the risk environment for all startups even more. It increases the challenges founders might have in dealing with the investor factor. Faced with heightened uncertainty, VC investors are bound to expect founders to take investor concerns over risk even more seriously. For that reason, the current state of the market makes it urgent for founders to tackle the investor factor head-on.

How startups can manage risk by managing investor relationships

In view of the current state of the VC investment market, what approach can startup founders and business leaders take in dealing with investors? How much say should investors have in how the startups they invest in are run?

In considering the answers to these questions, it’s important to keep in mind that the relationship between investors and founders should be mutually beneficial. VC investors put a lot of money on the line when investing in a startup, but founders also dedicate much of their lives to building up the business. Founders looking for potential investors should consider whether to be more selective in accepting funding from investors if such investments end up restricting how the company is run.

Here are some issues founders should consider when deciding how to manage relations with their investors:

- Entrepreneurial experience: Are the prospective investors experienced entrepreneurs themselves? Did they found any startups? Do they know what you’re going through? Having prior experience as an entrepreneur is often a prerequisite to being a successful VC investor.

- Shared interests and vision: Ensure that your interests and those of your investors are aligned. Do your investors care about your market and products? Not all investors are interested in sharing your mission and goals for your company, which could lead to conflict down the road.

- Having the right investors for the right stage: Many VC investors specialize in one growth stage or another. Angel investors, for example, have different interests and expectations than early stage or late stage VCs. Understanding the difference between investors can help minimize potential conflicts from the start.

- Addressing investor concerns: If investors are willing to identify key risk areas, it’s to your benefit to acknowledge those risks and provide solutions. What plans do you have for implementing DEI initiatives? How will you address concerns over the financial health of your company?

- Communicating risk concerns: In identifying the key internal and external risks to your business, it’s critical that you communicate those concerns to your investors. Why do these risks pose a threat to your business? What would it take to address those concerns?

- Having the right insurance coverage: Having proper insurance coverage is essential for managing risks faced by startups and business leaders. Keep in mind that most VC and private equity firms require startups to have directors & officers insurance (D&O) before approving any funding rounds.

Taking these issues into consideration can help founders manage their relationships with their investors, and in doing so, can lay the groundwork for addressing the risks that their companies face.

Managing investor relationships is all about finding common ground. Beyond any disagreements, the key issue for founders to consider is how they can integrate investor concerns over potential risks into their strategy and business planning for the startup.

Takeaway

Ultimately, startup founders and VC investors are united by a shared mission: to minimize the risks to their startup companies and help them succeed through the various growth stages. The results from Embroker’s Risk Index Report indicate as much, because despite the differences in what kind of risks founders and investors prioritize, their shared purpose is to mitigate those risks.

The investor factor isn’t about any differences between the interests of investors and founders. Rather, the investor factor should be seen as a way for founders and investors to assess their different approaches to risk-taking and seek common ground to help their companies achieve success in the future.