Do You Know What Your Business Insurance Policy Covers? (Quiz)

Business insurance is an important aspect of operating a business, but most owners aren’t clear on what's covered. Take our quiz and learn some of the intricacies involved in your policies.

Warren Buffett once famously said, “price is what you pay, value is what you get.”

You’re likely all too aware of the price you pay for your various business insurance policies, but do you know what coverage you do and do not get from them? We discovered many people are unaware of how their policy covers them (or doesn’t) in various situations.

Take the quiz below to test your knowledge of the ins and outs of business insurance. Or, jump to the answer key for detailed descriptions of each question. For a quick reference of what’s covered, you can also jump to our business insurance cheat sheet for business owners.

1 / 10

Which of the following types of business insurance are required by law if you have employees? (Select all that apply)

Based on your quiz results, the following information will be the most helpful to understanding business insurance:

Below is further reading on all quiz questions:

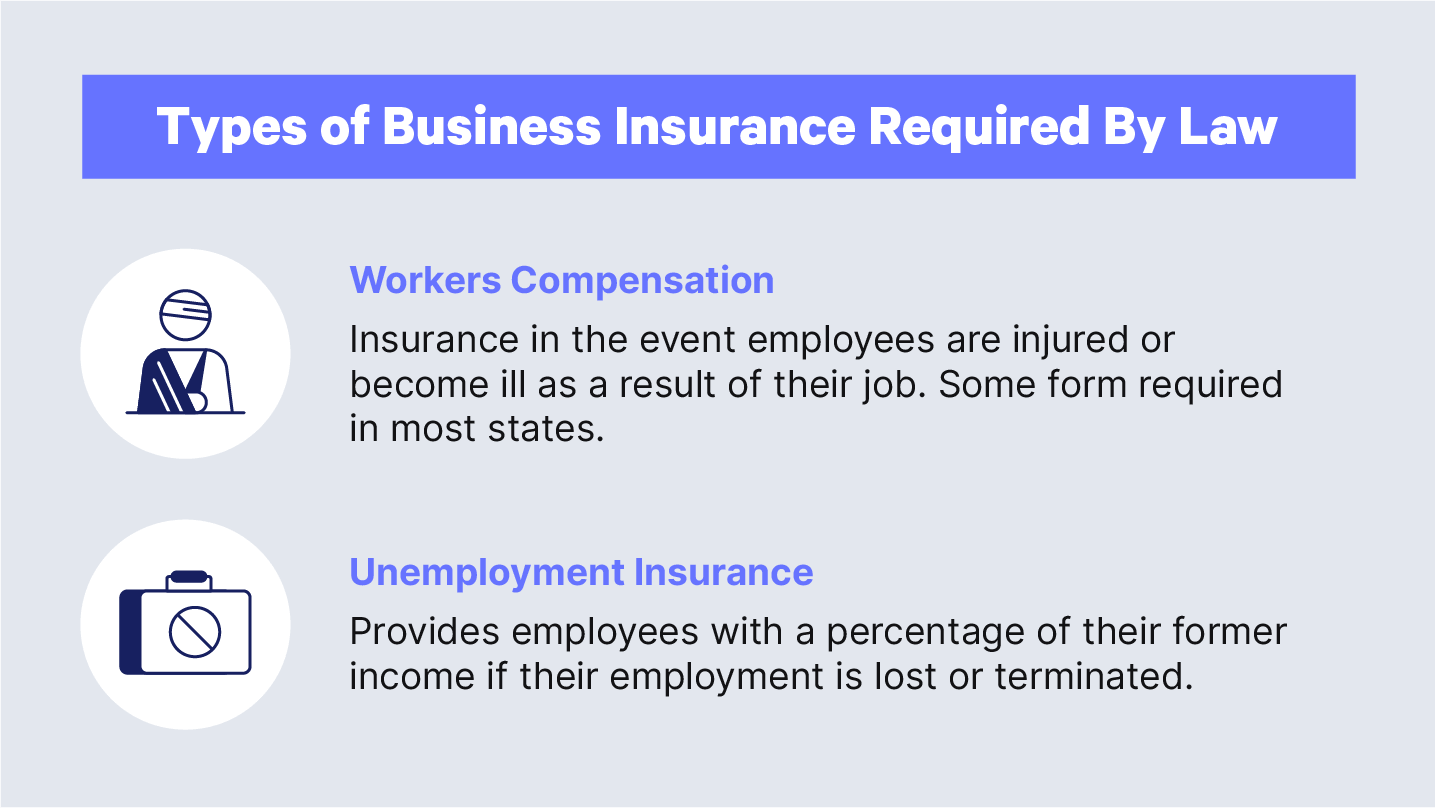

Question 1: Types of Business Insurance Required by Law

While it’s recommended to have multiple types of business insurance to protect your business in the event of an accident or catastrophic event, there are a few policy types required by law:

1. Workers Compensation

Workers compensation (WC) provides coverage for medical bills and lost time wages of employees when they are injured on the job – and is required by most states. WC is beneficial for both the employee and the business because the lost wages and medical bills that could otherwise be financially detrimental to the individual are now covered by insurance.

Workers comp requirements vary by state, but some form of it is legally required for the vast majority of business structures. Check out our guide to workers comp by state for more information regarding your business.

2. Unemployment Insurance

Unemployment benefits provide employees with coverage in the event their employment is lost or terminated. Most businesses, with the rare exception of some non-profits, are required to pay into State Unemployment Insurance (SUI) and the Federal Unemployment Insurance Act. The payments are usually levied in the form of a tax, either on the employer or employee.

Unemployment insurance, depending on the state, can be anywhere from 3 to 7 percent of the employee’s gross income.

Re-Lapse, It’s Only Workers Comp

While the legally required types of business insurance may seem straightforward, the ins and outs of them can be complex. Here’s an example:

A company disputed their workman’s compensation audit for the previous year, and last month, their policy expired. The company went one day without workers comp and now they can’t get approved for a new policy, and have to pay fines and penalties for not having coverage.

The only underwriter willing to cover them is the assigned risk pool or “state fund” or perhaps a PEO, or Professional Employer Organization. The assigned risk pool typically has higher rates, less service and less control over claims. But, a PEO essentially takes full control of managing HR-related processes such as payroll and, you guessed it, workers comp insurance. It can be very difficult to exit either of these structures, and so extremely important to maintain your WC insurance.

Turns out, the company only paid half the amount outstanding from the audit and potential insurers, for some reason, don’t want to work with a company that doesn’t pay.

If you’re in a similar situation, the first action is to sort out the audit dispute, but renew your policy. Get something from the carrier saying the audit is completed and satisfied. Then go back out to market for workers compensation.

Question 2: What Is Covered in a BOP (Business Owners Policy)?

A business owner policy, or BOP, provides a convenient package of insurance that many businesses need. BOPs typically combine general liability and property insurance, as well as business interruption insurance. Workers compensation is not covered in a typical BOP.

BOPs can be customized to cover specialized situations, depending on the risks unique to your business. Having adequate insurance for liability can protect you in the event of injury on your company property, such as a customer slipping, tripping, or falling and suing you for injury.

Questions 3 & 6: Commercial Auto Insurance on Company Vehicles

Most states require by law that company vehicles be insured by a commercial auto insurance policy and some states may even require uninsured or underinsured motorist coverage.

The amount of insurance required varies depending on the state, number of passengers, vehicle weight, and more. Some states, for example, require what’s known as a combined single limit (CSL), such as liability coverage for $500,000.

Other states may differentiate the required coverage amounts between bodily injury and property damage. The state of Illinois, for example, requires bodily injury coverage of $2 million and property damage coverage of $100,000 for vehicles expected to carry between 21 and 30 passengers.

If an employee is involved in an accident with an uninsured company vehicle, their personal insurance policy may be invoked to resolve the claim and may be legally and financially responsible. Besides being legally obligated to insure your company vehicles, reducing the liability placed on your employees will benefit your business greatly.

Question 4: Annual Risk Assessment

As your business evolves, so will the insurance risk profile and certain change factors can impact the price you pay in insurance premiums.

Length of time as an active business, for example, contributes to your underwriter’s calculation for insurance risk and premiums. If your business has experienced significant growth, mergers and acquisitions, or any other material changes to the company’s financial health, your insurance could be impacted.

Another positive signal to reduce insurance costs would be steady, predictable growth in revenue while simultaneously servicing debt levels. If your startup has its course set for outer space, you may find it beneficial to request an annual risk assessment from your insurance agent. Not all insurers do this, however, but you can ask about the service. If the insurer provides an assessment with recommendations, make sure you ask if the recommendations are required to be met or responded to within a time frame.

Question 5: Commercial Property Insurance

Depending on how your property insurance policy is structured, the coverage will vary. It should be tailored to protect your business against the risks in your geographic location. For example, if your business is located in California, wildfires are important to consider.

If a natural disaster or catastrophic event occurs and causes damage to your business, keep in mind that the current market value of your property is not the same as the amount your insurance policy values the property. Market value is what retailers and realtors use to sell you something, not insurers.

Most basic commercial property coverage is offered on an Actual Cash Value basis. ACV is the difference in Replacement Cost minus depreciation. If you are insured for the replacement cost of your property, that is better coverage than ACV. Replacement cost is the amount your insurance will cover to replace damaged or stolen property with “like kind and quality.” It does not take away value for depreciation. So, if an Italian light fixture in the conference room that was purchased before the artist made it big is damaged, and now the artists’ work goes for more — replacement cost will pay for things like kind and quality to replace it.

Questions 7 & 8: Employment Practices Liability Insurance

Employment Practices Liability insurance, or EPLI, covers companies against claims made by employees regarding the violation of their rights. This can include wrongful employment practices under which wrongful termination and sexual harassment would fall.

EPLI policies typically cover actual or alleged claims of unwanted behavior in the workplace such as discrimination, harassment, or sexual assault. This means that even if the claims are entirely false and the verdict not guilty, the policy will still provide coverage for legal costs.

Recently, however, claimants have worded their allegations intending to also try triggering D&O policies. It’s important to review coverage to ensure that EPLI and D&O “dovetail” in their coverages rather than potentially conflict.

Question 9: Professional Liability Insurance (E&O)

Errors and omissions on behalf of service providers, whether the service is legal, medical, financial, technical, or otherwise, are covered by a professional liability insurance policy, sometimes referred to as malpractice insurance.

If a technical consultant was made aware of a security vulnerability and failed to take action to remedy the issue, their client can sue for any damages that resulted from the exploitation of the vulnerability.

Question 10: D&O Coverage

In the past, executives with pending lawsuits would transfer assets under their spouses name to avoid seizure in the event the verdict is unfavorable. In response, lawyers would name the executive’s spouse in the lawsuit as well.

Spousal coverage clauses in Directors and Officers (D&O) insurance policies help protect the entire household in the event the executive is sued. The policy would not provide coverage in the event the spouse is at fault for the allegations brought forth by the claimant.

For example, if the spouse was charged with insider trading based on information gathered at a company party, the company’s D&O policy would not cover the spouse.

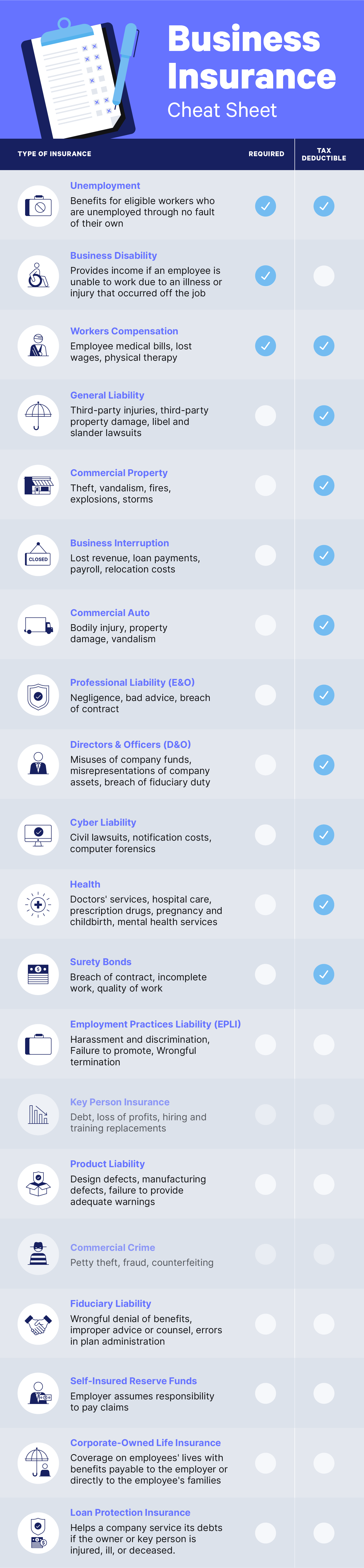

Types of Business Insurance Cheat Sheet

The sheer number of insurance instruments available to businesses can be daunting but doesn’t need to be. Depending on the specific risks associated with your business, your policies can be customized to best serve your protection while avoiding excess expenses or other repercussions.

To help business owners get a grasp on insurance quickly and easily we put together the cheat sheet below: